By Bea Patel, TLE Property Editor and Director of Shop for an Agent

With rising rail fare prices hitting commuters across the UK in 2016, could your house pay for your commute?

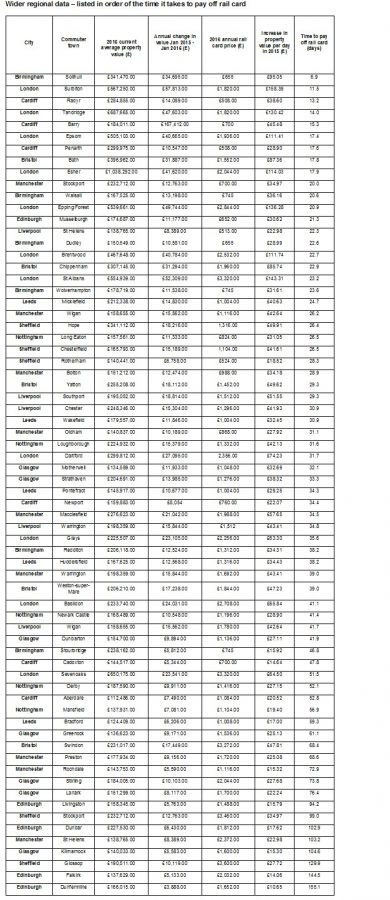

Website data analysed by Zoopla from 2015 compared average annual house price increases in some of the UK’s most popular commuter towns over the previous 12 months, to the cost of an annual train ticket. Results revealed how long it can take houses to increase in value enough to cover the annual cost of commuting.

Property owners in Solihull came top, where residents commuting into Birmingham could pay their yearly train travel in less than a week. The average property value increased by £34,695 last year (£95 a day) to £341,470. This means their rising property value could cover the £655 annual commute cost to Birmingham in just seven days.

In second place, Surbiton commuters pay £1,800 for their annual train travel into London. But with property prices increasing on average by £57,813 in 2015 (£158.39 per day) to £567,250, their homes will cover the travel cost in just 11 days. Homeowners in commuter hot spots in the South East also do well in the study, such as Dartford whose homes cover their travel cost in 32 days.

However, property owners north of the UK are not as fortunate. Homeowners in Dunfermline commuting to Edinburgh will need to work 155 days before the rising cost of their property will pay off the cost of their annual fare. Property owners from Falkirk to Edinburgh take 144 days and Glossop to Sheffield take 129 days.

The figures indicate the areas performing well in the UK’s property market. They also show how valuable homeowners find good transport links to major cities. By the end of 2015, the average British property was worth £290,827. It has risen in value by more than £20,000 – marking a bigger increase year-on-year than 2014.

The top 10 commuter hot spots where residents will be quickest to pay off their 2016 travel are:

1. Solihull to Birmingham – 7 days (by 7 January 2016)

2. Surbiton to London – 11 days (by 11 January 2016)

3. Radyr to Cardiff – 13 days (by 13 January 2016)

4. Tandridge to London – 14 days (by 14 January 2016)

5. Barry to Cardiff – 15 days (by 15 January 2016)

6. Epsom to London – 17 days (by 17 January 2016)

7. Penarth to Cardiff – 17.5 days (by 17 January 2016)

8. Bath to Bristol – 18 days (by 18 January 2016)

9. Esher to London – 18 days (by 18 January 2016)

10. Stockport to Manchester – 20 days (by 20 January 2016)

Lawrence Hall of Zoopla commented: “Our research shows how much property prices have increased in certain popular commuter areas over the last 12 months and also highlights just how expensive commuter-belt living can be. As we’d expect, properties in key commuting areas continue to be in demand for buyers in competitive markets.

“While our research may soften the blow of increased rail fares for home owning commuters, the price rises we’re seeing does make it harder for those looking to take their first step onto the property ladder. But with Government Help-to-Buy schemes still in place and the promise of new homes to ease demand, both buyers and sellers should have at least some reason to be upbeat as we go into 2016.”

See the wider regional data list in order of how long it takes to pay off your rail fare: