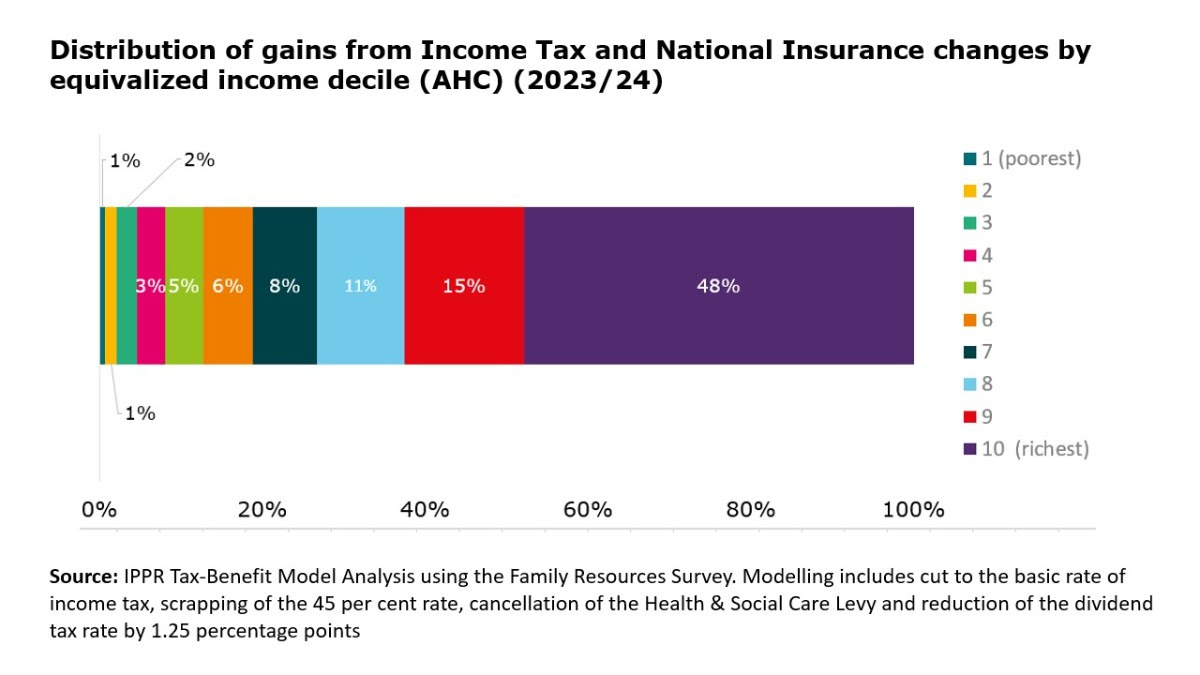

The highest earners in the UK will disproportionately benefit from personal tax cuts announced by the chancellor in today’s fiscal event, with the richest 10 per cent of the population receiving 48 per cent of the gains, finds IPPR.

The poorest 10 per cent of society meanwhile will see less than 1 per cent of the financial benefit. In fact, the poorer half of society will share just 12 per cent of the money between them.

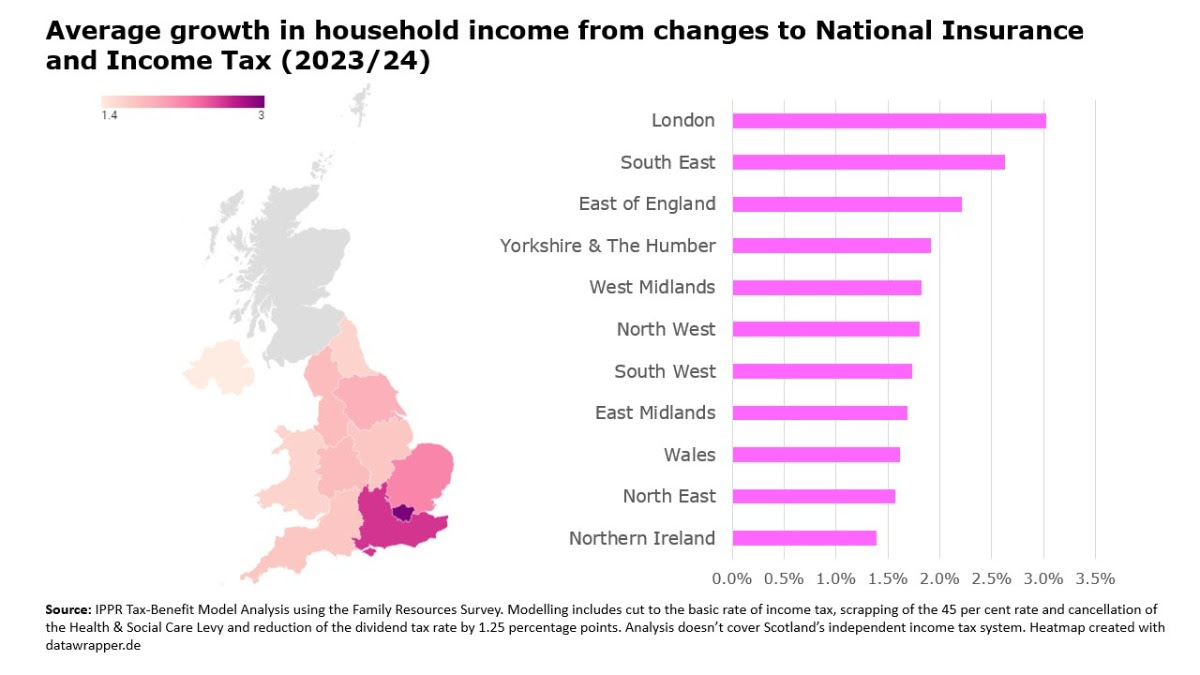

People living in London and the South East of England will see significantly larger gains than those living in the rest of the country. Londoners will see double the income growth compared to households in Northern Ireland, putting the government’s levelling-up commitments at serious risk.

Henry Parkes, senior economist at IPPR, said: “This mini-budget was a max boost for the richest, and shows a government staggeringly out of touch with lower and middle earners. As the country grapples with a cost-of-living crisis, soaring energy bills and high levels of inflation, tax cuts for millionaires should not be the priority.

“Worryingly, these cuts will also undermine the levelling-up agenda. Families across Wales, Northern Ireland and the north of England will feel more left behind than ever. If the government really wants to help ordinary people, then they would be better off investing in what the economy actually needs – better health, education and skills.”

Related: Sinn Fein calls for ‘urgent’ border poll on Irish unity