Almost a third of companies receiving coronavirus bailouts from the Bank of England are based in a tax haven or owned by someone living there, shocking research has revealed.

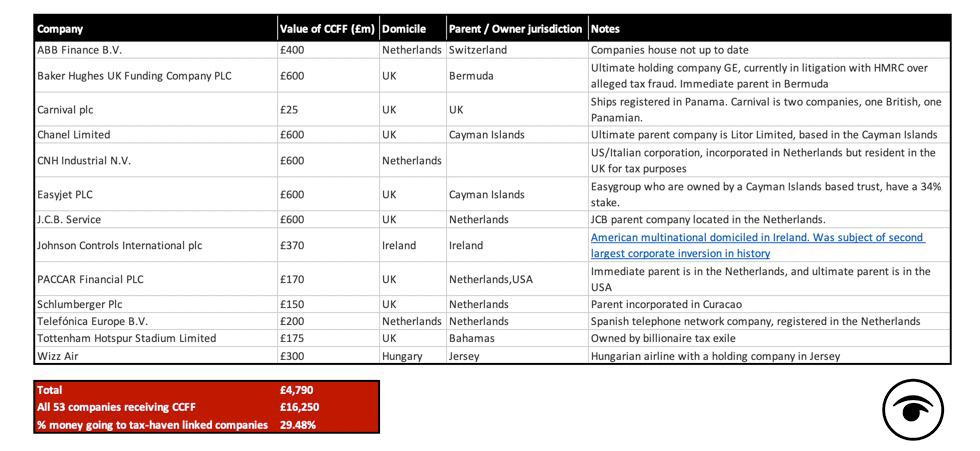

Analysis by TaxWatch UK, a thinktank, found that £4.79 billion in bailout cash has been handed to companies with links to tax havens, or that have been embroiled in financial controversy – close to 30 per cent of the money loaned out under the government’s Covid Corporate Financing Facility.

One company – Baker Hughes, a subsidiary of American giant General Electric – was granted a £600 million loan, despite the fact that its parent company has been sued by HMRC over unpaid taxes dating back 16 years.

Luxury fashion brand Chanel – whose ultimate parent company is based in the Cayman Islands – also received £600 million, as did EasyJet – which is part-owned by a trust based in the Caribbean territory.

A further £25 million went to cruise operator Carnival, whose ships were registered in Panama. Dozens of people have died and over 1,500 confirmed cases of Covid-19 have so far been recorded in connection with the company’s cruises, after major outbreaks on ships like the Diamond Princess earlier this year.

Machine manufacturer JCB – whose parent company is located in the Netherlands – received a £600 million bailout. The company donated more than £50,000 to Boris Johnson in 2019 and its chairman, Lord Bamford, contributed a further £20,000 to the prime minister’s leadership campaign.

‘Utterly disgusted’

Critics have lambasted Britain’s reluctance to prevent companies registered offshore from accessing government bailouts, a move taken by a host of other countries – including the devolved administrations in Scotland and Wales.

Dame Margaret Hodge, chair of the All-Party Parliamentary Group on Anti-Corruption and Responsible Tax, said: “I am utterly disgusted at the big companies that avoid paying their fair share of tax that have been abusing the Government’s support schemes during the pandemic.

“Saving jobs is of course important. But only businesses that pay into the common pot for the common good should have any right to financial assistance from the taxpayer.”

The UK’s controlled foreign company rules mean that UK tax resident corporations are not normally liable to pay corporation tax on profits made outside of the country, making it an attractive tax haven for multinationals.

George Turner, director of TaxWatch UK, said: “Unlike many other countries in the world the UK has decided not to put any conditions on the tax conduct of companies receiving government support.

“There are understandable concerns that the government should seek to do everyone to support employment, and that preventing companies from receiving support may end up with job losses.

“However, there are clearly ways in which governments can structure conditions in a smart way to ensure better tax compliance. One idea for example, would be to force companies receiving support to publish more information on their tax payments around the world.”

Several companies based in countries like the Netherlands received significant government funding, despite having UK subsidiaries.

Iberdrola BV – the Dutch branch of a Spanish energy giant – owns Scottish Power, and received a significant loan from the Bank of England. It is not clear why the money did not go directly to Scottish Power.

‘Priority must be on eliminating tax avoidance’

Robert Palmer, executive director of Tax Justice Network UK, an independent advocacy group, said: “It’s infuriating if companies that appear not to contribute in the good times, come cap in hand for a bailout when things get tough.

“Other countries have implemented a ban on tax haven based-companies getting bailouts. This is a blunt tool. Much better would be to impose legally binding conditions.”

France was one of the first countries to block offshore firms from claiming state aid, banning companies domiciled in tax havens from accessing its 110 billion euro rescue package. Announcing the ban Bruno Le Maire, the French finance minister, said that “it goes without saying” that “if your head office is located in a tax haven, you cannot benefit from public support.”

Other companies receiving assistance from the UK government include Hungarian airline Wizz Air – which has a holding company in Jersey – and Tottenham Hotspur Stadium Limited, which is owned by a billionaire tax exile living in the Bahamas.

With priority now shifting towards Britain’s economic recovery from the pandemic, experts have urged the government to make a concerted effort to crack down on tax avoidance.

Turner added: “Once we have passed the immediate phase of the crisis, the priority must be for the government to focus its efforts on eliminating tax avoidance and making sure that everyone makes their contribution.

“People were rightly angry to see the companies of well known tax exiles being granted government support – but the fact of the matter is that it is entirely our choice to allow British citizens to live in Monaco tax free.

“There would be nothing to stop the government making sure that income from the UK was taxed before it got to the British Virgin Islands, Monaco, or a number of other well known tax havens.”

Related: Pressure mounts on Sunak as Scotland bans Covid-19 support to firms based in tax havens