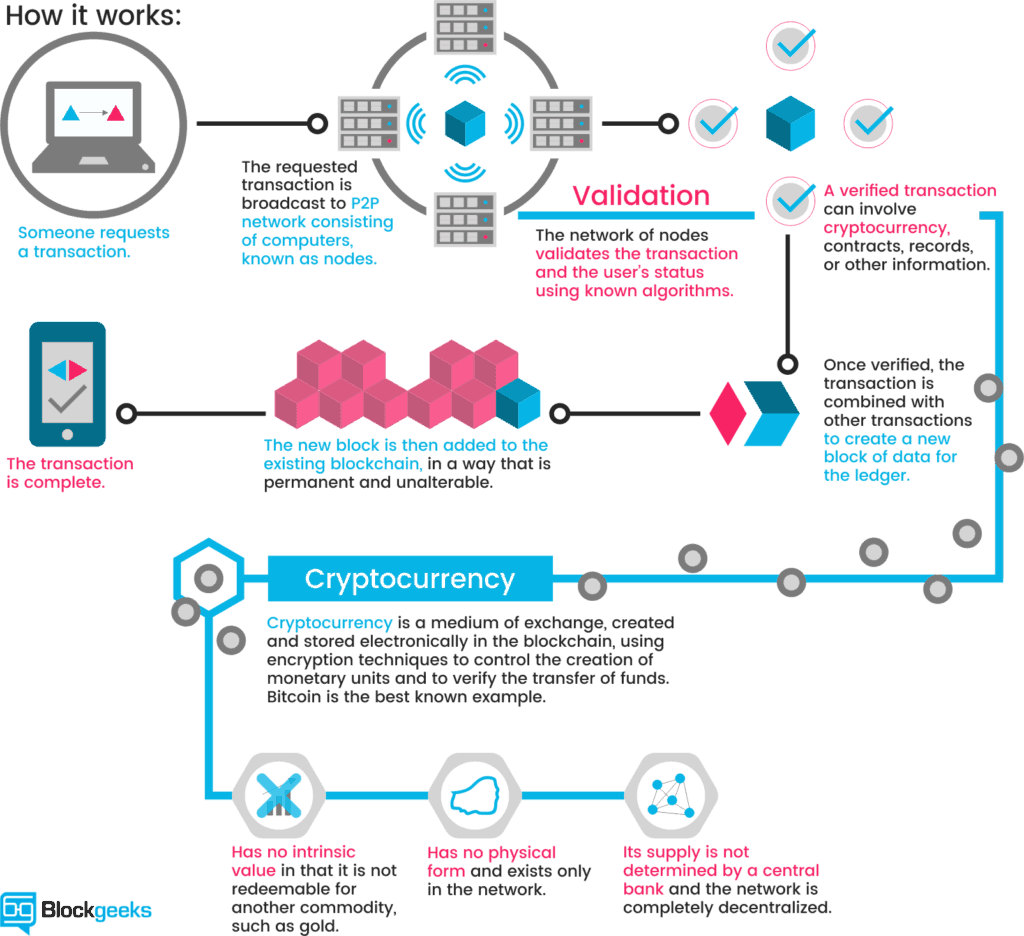

Cryptocurrencies are decentralized currencies, they are purely digital, they are not controlled by any centralized institution, and they exist in code. The decentralized digital nature of cryptocurrencies, however, means that their transactions are irreversible because of the inherent immutability that makes it hard to retroactively alter data stored on the Blockchain. Unfortunately, cryptocurrencies, when stolen, can’t be retrieved and this is one of the reasons many people are skeptical about buying cryptocurrencies.

In 2019 alone, at least £659M worth of cryptocurrencies has been stolen from cryptocurrency exchanges in different parts of the world. In January, Japanese crypto exchange suffered an attack in which about £434.36 worth of NEM coins were stolen. NEM Foundation president Lon Wong referred to the hack as the biggest theft in the history of the world. In February, Italian crypto exchange Bitgrail suffered a hack in which the perpetrators made away with £158M worth of Nano tokens.

In June, hackers hit the South Korean crypto exchange Coinrail and £30.3million worth of Pundi X and Aston tokens were stolen. A few weeks later, rival Bithumb became the victim of a hack in which about £24.4M worth of crypto was stolen. Bitrue and Gatehub have also being hacked with users losing a combined £12.20M worth of ADA and XRP tokens.

In some cases, the hacked exchanges will find a way to return a part (or all) of stolen funds to users from their reserves. In most case, there’s usually not much respite for the users whose funds were stolen in a hack. This piece provides practical insights on how to buy and sell crypto without fear of losing your coins.

Put your crypto in cold storage

One of the most secure ways to store cryptocurrency securely is to put your coins in a cold storage device and then lock up the device in a secure location. Cold storage for cryptocurrencies simply refers to the act of storing cryptocurrencies in an offline wallet that is not connected to the internet. The offline nature of cold storage mitigates the risk of cyber hacks, unauthorized access and other vulnerabilities that bedevil internet-enabled devices.

Some of the most popular crypto cold storage methods include paper wallets, hardware wallets, desktop wallets, and USD drives.

- Hardware wallets are the most secure, followed by USB drives, desktop wallets, and paper wallets.

- Desktop wallets are the easiest to use, followed by USD drives, hardware wallets, and paper wallets.

- Paper wallets are typically the cheapest, followed by desktop wallets, USD drives, and hardware wallets.

However, it is important to note that cold storage devices are not universal for the 2,600 coins in the market and you need to be doubly sure that your cold storage device is compatible with the cryptocurrency you want to store. You may also think critically about the ease of restoring your wallet if it becomes lost or damaged.

Use a security-focused cryptocurrency exchange

Another way to ensure the security of your cryptocurrency is to use a cryptocurrency exchange that historically places a premium on the security of user funds. Security is a work-in-progress, no exchange is 100% immune from hacks, and even the biggest exchanges such as Binance have fallen victim of successful crypto hacks.

When buying crypto on an exchange, it’s in your best interest to buy cryptocurrencies from an exchange operating under the regulatory environment in top-level jurisdictions as opposed to exchanges domiciled in questionable offshore locations.

Skrill, which started as a fintech company under Paysafe Holdings UK Limited has developed expertise in delivering secure, quick, and simple digital payments. The company has been delivery secure payment solutions since 2001 before the launch of Bitcoin. It is a global company with a London HQ, operational offices in the U.S. and Europe, and with staff representing more than 30 nationalities.

In 2018, Skrill became more actively involved in the cryptocurrency industry and it provides a dedicated service that makes it easy for users to buy and sell cryptocurrencies securely. Also, Skrill offers users a near-instant Fiat-to-Crypto gateway that makes it easy to convert your cryptocurrencies to fiat on the go via the web or its mobile apps on iOS and Android.

The key reassuring feature that Skrill offers over other exchanges is a reliable and trustworthy custodianship service. Both Skrill and its parent Paysafe Group, which has annual revenues of more than $1.9B are regulated by the Financial Conduct Authority (FCA) under the Electronic Money Regulations 2011.

If you don’t want to go through the hassle of transferring and securing private keys using cold storage, a crypto solution such as Skrill is undoubtedly the next best option.

Explore decentralized exchanges

Decentralized exchanges are somewhat complex, but they ensure another layer of security when buying and selling cryptocurrencies. The core functions of a crypto exchange are asset exchange, order books, order matching, and capital deposits. Most of the popular exchanges are centralized in that they have a central repository for managing those core functions.

The fact that capital deposits are centralized with user funds stored in hot/cold wallets provides a single point of failure that could be attacked and exploited to steal funds as been recorded in the past breaches.

A truly decentralized exchange such as BlockDX decentralizes all the four core functions of exchanges. Hence, it doesn’t hold capital deposits, users are in full control of the private keys of their coins and they only transfer their coins to matching trades in the marketplace when they are actively trading.

Decentralized exchanges are still novel and some of the most popular DEXs are hybrid solutions. However, if you are willing to undertake the steep learning curve of navigating a DEX, you could find it inherently more secure than centralized exchanges.

Conclusion

Irrespective of whether you want to buy and sell cryptocurrencies using cold storage, crypto exchanges, or decentralized exchanges, you still have the personal responsibility to adopt some measures to protect your crypto assets. Some of the measures below while not exhaustive proactively prevent your coins from being stolen in a hack;

- Strong passwords

- Two-factor authentication is underrated

- Not bragging about owning crypto

- Avoid giveaways and doubler schemes

- Pay special attention to URL and wallet addresses

It is important to note that security is a journey and not a destination; hence, there’ll always be the need to proactively protect your crypto assets. Determined cybercriminals will always be looking for vulnerabilities to exploit, but proactive security measures will make your coins less attractive to opportunistic hackers.

Finally, the cryptocurrency industry is still very young but as it matures, we can expect to start seeing regulatory provisioning that protects user funds much in the same way that bank deposits are guaranteed and insured.